Copyright © 2023 VGV Media Asia Ltd. All Rights Reserved

Struggling to keep up with the fast-changing world of social media in Asia? You're not alone. With over 2.5 billion users across the Asia-Pacific region, brands are facing more pressure than ever to stand out in one of the world’s most mobile-driven and app-savvy markets.

What makes it even more challenging? Each country has its own favorite platforms, cultural habits, and digital behavior. From TikTok's explosive rise in Southeast Asia to Japan’s loyalty to X (formerly Twitter), the diversity can be overwhelming, but also full of potential.

In this article, we’ll break down the hottest social media apps in Asia by country, explore current user trends, and give you a clear outlook on what platforms are growing fast. If you're planning your next digital marketing move, this guide will help you stay one step ahead.

If you think social media in Asia is all about Facebook and Instagram, think again. While global giants like YouTube, X, and Meta still hold strong positions, the real action often happens on platforms that are homegrown and tailored to local cultures. Apps like WeChat and Douyin in China, LINE in Japan, and KakaoTalk in South Korea dominate their markets, and may not even be on your radar if you’re outside the region.

Here we’ll walk you through the top social media apps in Asia, why they matter, and how people are using them for everything from chatting and shopping to discovering new brands.

Ever wonder what app nearly every person in Japan, Taiwan, and Thailand uses daily? Not Facebook, not Instagram, it’s LINE. Originally launched as a messaging app, LINE has evolved into a comprehensive super app, offering a wide range of services including stickers, games, news, mobile payments, and e-commerce.

In Japan, LINE has over 97 million monthly active users, covering roughly 75% of the population. In Taiwan, over 90% of people use it, and in Thailand, it’s installed on 95% of mobile internet users’ devices. LINE is the top social platform in all three markets, thanks to its deep integration into everyday life.

For marketers, LINE is a goldmine. Businesses can create official accounts to push updates, promotions, and even distribute coupons directly to users. LINE Ads allow brands to target Japanese users by demographics or interests, many of whom aren’t active on Facebook. In Thailand, it’s also a key commerce tool, especially among SMEs who manage sales directly via chat or LINE shops. If you’re targeting these countries, LINE should be at the heart of your strategy.

How do you reach almost everyone in South Korea with just one app? You use KakaoTalk. Used by about 87% of the Korean population, KakaoTalk is far more than a chat app—it’s the digital heartbeat of daily life in South Korea.

Users chat, share content, shop, make payments, and even manage daily tasks like booking a taxi or checking the weather, all through KakaoTalk. For businesses, Kakao Plus Friend is a powerful feature that lets brands send personalized updates, offers, and customer messages directly to users who follow their accounts.

While Koreans also use YouTube and Instagram for content, KakaoTalk is where customer relationships are managed. Every serious marketing campaign in Korea typically pairs content on visual platforms with engagement and communication through Kakao, especially in industries like retail, food & beverage, and entertainment.

Think Google meets Buzzfeed, Amazon, and Reddit, that’s Naver in South Korea. With 39 million monthly active users, Naver dominates how Koreans search, shop, and consume content. It’s not just a search engine; it’s where people read the news, blog, browse product reviews, and even follow communities via Naver Café.

While Google is growing in Korea, Naver still owns the Korean-language web thanks to its ultra-localized results and features. Brands love it for Naver Blog SEO, curated shopping ads, and deeply engaged audiences. Platforms like Knowledge iN and Naver Webtoon help position it as a trusted content hub, while its integration with LINE and other services makes Naver central to South Korea’s digital life.

If you’re marketing in Korea, don’t just “Google it”, but “Naver” it. It’s where Korean audiences actually are, and it’s essential for organic and paid strategies alike.

Sina Weibo, often called “China’s Twitter”, remains a major force in Chinese social media with 583 million monthly active users as of mid-2024. Unlike WeChat’s more private, circle-based communication, Weibo is open and content-driven, perfect for following influencers, celebrities, and breaking news. It’s the platform where trends start and go viral.

Despite slower growth, its massive user base makes it a key channel for public campaigns, buzz marketing, and brand awareness. Weibo is especially valuable for KOL marketing, where brands team up with influencers to reach large audiences fast. Whether it’s a product launch, brand statement, or social conversation, Weibo gives companies a way to be seen and heard widely in the Chinese digital space.

WeChat (Weixin) is not just a messaging app, it’s China’s all-in-one digital lifestyle platform. With 1.38 billion monthly active users, it’s used by almost 87% of China’s population. WeChat is like having WhatsApp, Facebook, PayPal, Uber, and Amazon all rolled into one powerful super app.

Users rely on it for chatting, browsing social feeds (known as Moments), paying bills, ordering food, hailing taxis, and shopping, all within one interface. For brands, WeChat offers official accounts to share content, WeChat Pay for seamless transactions, and Mini Programs, which are like mini websites or apps within WeChat itself. These allow companies to host stores, games, services, and loyalty programs.

While its reach outside China is limited to Chinese-speaking communities in places like Singapore, Malaysia, and Hong Kong, WeChat is indispensable for any brand targeting the mainland Chinese market, especially since Western platforms are blocked there.

TikTok (and Douyin) have completely reshaped how people in Asia consume and create content. TikTok (excluding China) boasts over 1 billion active users all over the world and an impressive 1.56 billion monthly reach for ads.

In Southeast Asia, its popularity is off the charts. Indonesia and the Philippines are among the world’s top countries for time spent on TikTok, with users spending an average of 40 minutes per session. Across Vietnam, Thailand, and Malaysia, TikTok ranks in the top 5 most-used platforms, driven by a young, mobile-first audience that thrives on quick, entertaining content.

In China, its domestic sibling Douyin has around 755 million monthly active users and has evolved beyond dance videos into a robust e-commerce and live streaming platform. For marketers, these platforms offer endless opportunities—from viral hashtag challenges and creator collaborations to in-app shopping and live product demos. If you're targeting Gen Z or millennial buyers in Asia, TikTok and Douyin are essential tools in your strategy.

If there’s one platform you must include in your Asia marketing strategy, it’s Facebook. With 2.9 billion monthly active users worldwide, it continues to dominate countries like Indonesia, the Philippines, Malaysia, and Vietnam.

In many of these markets, Facebook isn’t just a social platform. It’s essentially the internet. Users rely on it for everything from chatting and news updates to watching videos, joining local groups, and even shopping through Facebook Marketplace and Shops.

In the Philippines, Facebook’s ad reach surpasses 113% of the eligible population, driven by the widespread use of multiple accounts. Vietnam and Malaysia also show impressive reach, with over 80% of adults active on the platform.

For marketers, Facebook is an essential channel offering business pages, live streaming, targeted ads, and Messenger-based customer support. It’s ideal for building brand awareness, running e-commerce campaigns, and connecting with a diverse user base across age groups.

You may not think of WhatsApp as a traditional “social media” app, but in Asia, it plays a crucial role in communication and commerce. It is widely used for daily chats, voice calls, and sharing updates, but its business features are what make it a standout for marketers.

With around 2.0 billion users globally, it’s the top messaging app in many Southeast Asian countries. In Singapore, 74.7% of the population uses WhatsApp, and in Malaysia, it’s practically on every smartphone.

Through WhatsApp Business, brands can set up product catalogs, send out broadcast messages, use auto-replies, and even support customer inquiries in real-time. While not flashy, WhatsApp excels in high-trust, personalized interactions, which is perfect for service industries, local sellers, and direct-to-consumer outreach in Asia’s mobile-first markets.

Want to win the hearts of young, urban, and trend-savvy consumers? Instagram is where you need to be. With 2.0 billion global users, its visual-first design and influencer culture make it a must for brands in fashion, lifestyle, travel, and beauty.

In Japan, over 60% of internet users are on Instagram, while South Korea has over 20 million users. In Malaysia and Singapore, Instagram ads reach more than half the adult population—55% and 59%, respectively.

Brands benefit from a range of features like Reels, Stories, Shoppable posts, and influencer partnerships. Instagram is especially effective for storytelling and visual branding, making it a must for businesses targeting millennials and Gen Z in Asia’s consumer-driven cities.

Looking to tap into Asia’s video-first culture? YouTube is your best friend as it ranks in the top two social networks in nearly every country. With 2.5 billion users worldwide, YouTube attracts all ages and interests, ranging from music and entertainment to tutorials, product reviews, and livestreams.

In Indonesia, 139 million users (about 75% of internet users) tune in regularly. Thailand has around 44 million users, while in Malaysia, YouTube reaches 93% of the internet population. YouTube usage in Taiwan reaches nearly its entire social media user number of 19.2 million.

The platform’s strength lies in long watch times and video SEO, making it perfect for storytelling, how-to content, and high-impact brand ads. Marketers can also leverage YouTube Shorts for viral-style content, collaborate with local creators, and build branded channels that drive both reach and engagement.

Why is Twitter (now X) still thriving in Japan while it struggles elsewhere in Asia? The answer lies in Japan’s unique social behavior online. With over 73 million users, nearly 60% of the population, Twitter is Japan’s second-most popular social platform.

Unlike Facebook, which emphasizes real names and connections, Japanese users prefer Twitter’s anonymous and real-time nature, making it perfect for following news, trends, pop culture, and celebrities. Outside Japan, Twitter also has pockets of influence in countries like Indonesia and maintains active communities in Thailand and the Philippines, especially around trending hashtags and live events.

However, it generally ranks behind Facebook, YouTube, and Instagram in user base. For marketers, X (Twitter) is best suited for PR campaigns, trend-jacking, and real-time engagement, particularly in Japan. It’s not always the core marketing channel, but it plays an important supporting role in fast-moving campaigns and buzz marketing across the region.

Meta’s Threads, launched in mid-2023 as a rival to X (formerly Twitter), is steadily gaining a foothold in Asian markets, especially among Instagram-savvy Gen Z users. While global growth made headlines with over 100 million signups in just 5 days, Threads’ momentum in Asia has been more organic, driven by users in countries like Japan, Taiwan, and Indonesia exploring alternatives to Twitter-style platforms.

In Taiwan, Threads saw a spike in usage during the 2024 elections, widely used for political commentary. In Japan, where anonymity is valued, Threads is growing among younger users but still trails behind X. Its integration with Instagram helps, as over 60% of its users in Asia are aged 18–34 in 2024, and brands are experimenting with Threads-first content strategies to test engagement. While not yet a social giant here, Threads is a watchlist app for marketers eyeing real-time trends and micro-influencer spaces in Asia.

Before diving into country-by-country details, let’s look at the big picture. Social media penetration is highest in connected markets like South Korea, Singapore, and Malaysia (85–93%), while Indonesia shows big growth potential with only half its population online. China dominates in user numbers, over a billion, but its penetration sits around 75%.

| Country |

Social Media Users |

% of Population |

| China |

1.06 billion |

~75% |

| Japan |

97.0 million |

79% |

| South Korea |

48.34 million |

93.4% |

| Taiwan |

19.2 million |

80.2% |

| Thailand |

49.1 million |

68.3% |

| Vietnam |

76.2 million |

75.2% |

| Malaysia |

28.7 million |

83.0% |

| Philippines |

86.75 million |

~73% |

| Indonesia |

139.0 million |

49.9% |

| Singapore |

5.16 million |

88.2% |

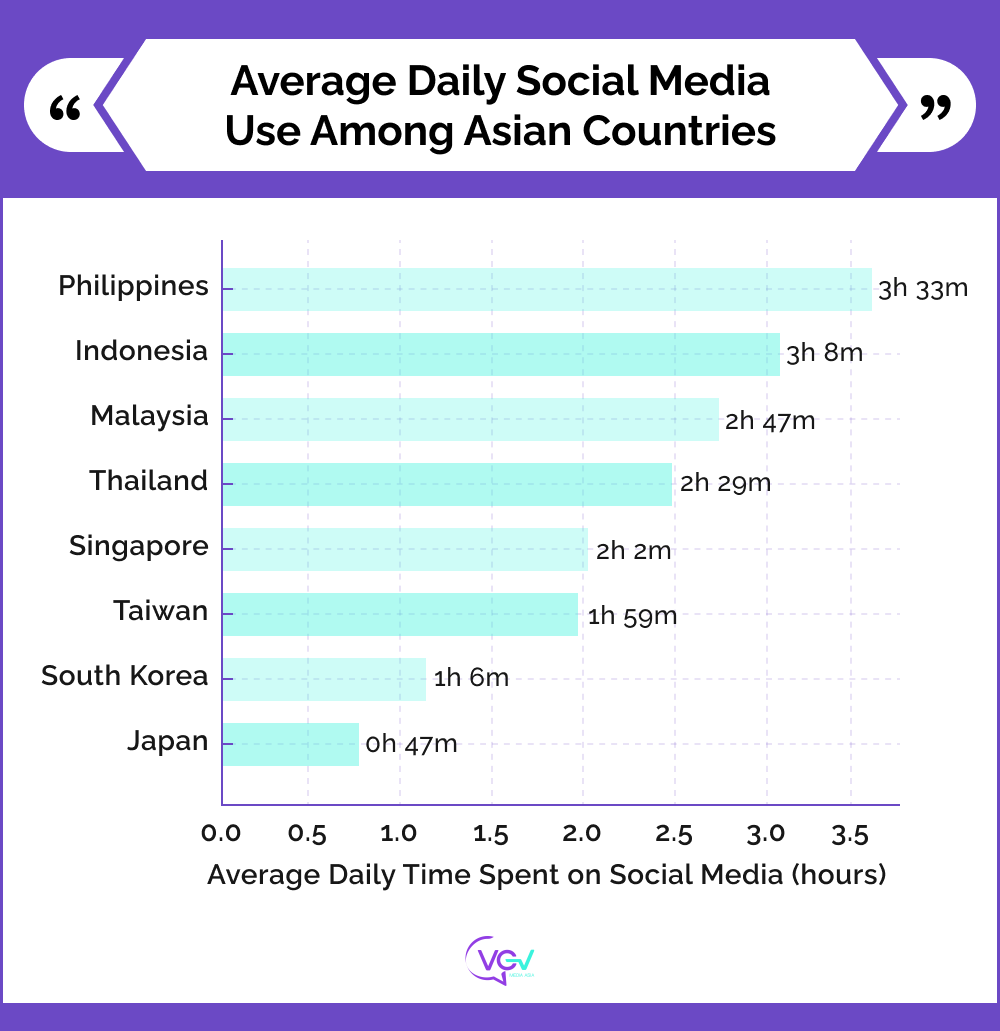

When it comes to daily usage, Southeast Asians are the clear heavyweights. Filipinos top the chart at 3 hours 33 minutes a day, followed closely by Indonesians, Malaysians, and Thais, far above the global average of 2 hours 19 minutes. In contrast, Japanese users average just 47 minutes daily, preferring more private or passive platforms. South Koreans also clock in low at 1 hour 6 minutes, reflecting more diversified digital habits beyond social media.

Japan’s social media landscape is unlike any other. Around 97 million people (79% of the population) are active users, but their habits and platform preferences set them apart. The real star among all platforms is no doubt LINE, Japan’s go-to messaging app with 97 million monthly active users. It’s more than just chat—it’s a super-app with news, payments, and entertainment baked in. For marketers, LINE is gold: perfect for push notifications, in-app ads, and building customer relationships through official accounts. If you're not on LINE, you're missing Japan’s main digital artery.

When it comes to open networks, Twitter (now X) reigns supreme with over 73 million users. Japan is Twitter’s second-largest market globally, thanks to the cultural preference for anonymity and real-time updates. People use it to follow trends, anime news, celebrities, and to share opinions without revealing their identity. It’s the go-to for creating buzz, launching trending hashtags, and tapping into live conversations. In contrast, platforms like Facebook never caught on, as their real-name culture and public sharing didn't resonate as strongly.

Meanwhile, Japan’s digital scene includes quirky, niche platforms like Niconico (famous for its real-time comment overlays) and Ameba blogs, great for targeting subcultures, but not the mainstream. The key challenge? Japanese users merely spend less than an hour a day on social media. So, to win attention, your content needs to be sharp, relevant, and culturally on-point. Prioritize quality over quantity, and focus on platforms where Japanese users are most engaged.

With 93.4% of the population active on social media, South Korea is one of the most digitally connected markets in the world. At the heart of it all is KakaoTalk, used by nearly everyone (87% penetration). It’s more than a messaging app; it’s a digital lifestyle hub where users chat, shop, read news, hail taxis, and more. For marketers, having a Kakao Plus Friend channel is practically essential—it's a powerful CRM tool for sending messages, coupons, and updates directly to followers.

Beyond messaging, YouTube dominates content consumption, used by 44.3 million Korean internet users. From K-pop to mukbangs, Korean creators have a massive influence. Instagram is strong too, especially among younger users and lifestyle brands, with around 20 million local users. TikTok is growing, particularly with Gen Z, but hasn’t surpassed YouTube or Instagram yet. Facebook is fading, though still used for logins and some niche engagement

One standout feature: Koreans average just 1 hour and 6 minutes daily on social media and manage fewer accounts (about 4.3), showing more selective engagement. Naver Cafes and Daum communities remain key for niche marketing. For brands, the winning formula in Korea is video-first content, strong KakaoTalk integration, and smart use of localized platforms like Naver for SEO and blog-style outreach.

Taiwan’s social media scene is a vibrant mix of Western giants and Asian favorites. With about 19.2 million users (80% of the population), nearly everyone in Taiwan is on YouTube, making it the country’s top platform. Close behind are Facebook (16.95 million users) and LINE, which dominates messaging with a 91% penetration rate. What makes Taiwan unique is how seamlessly users switch between global networks like Facebook, Instagram, and YouTube, and local staples like LINE, often using all in one day.

Meanwhile, LINE is the default communication tool across families, schools, and businesses. Brands frequently use LINE Official Accounts for direct engagement, promos, and customer support. Instagram and TikTok are gaining momentum, especially among younger users. Twitter, however, has minimal presence. Instead, public discussion often happens on PTT, Taiwan’s influential Reddit-like forum.

Taiwanese users are multi-platform masters, averaging 6.1 social accounts and spending around 2 hours daily online. For marketers, the best strategy is cross-platform campaigns, smart social listening, and active community management, especially on Facebook and LINE.

China’s social media landscape is massive, fast-moving, and completely distinct. With over 1.06 billion users (roughly 75% of the population), it’s a walled-off digital world where global platforms like Facebook and YouTube are blocked, and local giants thrive. At the core are the “Big Three”: WeChat, Douyin, and Weibo, which we have introduced previously.

Other rising stars include Xiaohongshu (Little Red Book) for fashion and beauty recs, Bilibili for Gen Z subcultures, Zhihu for thought leadership, and Kuaishou for live commerce in lower-tier cities. Chinese users often juggle multiple platforms—marketers need a localized, multi-channel approach. To succeed, integrate social with e-commerce, partner with local influencers, and be agile, because in China, social media doesn’t just support your marketing, it is your marketing.

Thailand’s social media scene is lively and commerce-focused, with 49.1 million users (68% of the population) spending an average of 2.5 hours daily online.

At the heart of it all is Facebook, used by essentially all Thai social users. It’s not just for connecting with friends; it’s a shopping channel, news feed, and content hub rolled into one. Thailand is a global leader in social commerce, with live selling, Facebook Pages, and Stories driving real conversions. Over 70% of Thai users report buying more due to Stories, making Facebook and Instagram crucial for B2C marketing.

Next is YouTube, with around 44 million users, reflecting Thailand’s high video consumption. But for daily chats and customer relationships, LINE dominates. Installed on 95% of Thai smartphones, LINE is where Thais text, follow brand accounts, and even place orders. Businesses use LINE Official Accounts and branded stickers to build loyalty, while LINE Ads and CRM tools help brands stay top-of-mind.

Younger Thais love Instagram for lifestyle content and TikTok for short-form fun, especially music and dance. TikTok’s explosive growth has made it a go-to for influencer marketing and viral campaigns. Meanwhile, Pantip, a classic Thai forum, still shapes opinions in niches like travel and tech. For success in Thailand, think multi-platform: Facebook and Instagram for reach, LINE for retention, and TikTok for buzz, always localized, always playful.

Vietnam’s social media scene is buzzing with a total of 76.2 million users (75% of the population), and a stunning 92.7% of internet users are active on social platforms. Facebook is king—it’s where Vietnamese go to chat, read news, shop, and join community groups. Facebook Marketplace and seller groups are buzzing with informal e-commerce, and Messenger remains one of the top ways people communicate daily. For broad reach, engagement, and advertising, Facebook is the go-to.

Vietnam also boasts a strong local player: Zalo, used by over 80% of internet users. Zalo is much more than a messenger—people use it to pay bills, access government services, and connect with local businesses. For marketers, Zalo Official Accounts are essential for CRM, especially outside big cities where Zalo’s fast, lightweight interface wins. A Zalo presence is key for customer support and promotions via messages or group chats.

A defining trend in Vietnam is social commerce, with nearly 60% of social media users having bought through social apps. Brands often skip e-commerce sites and sell directly via Facebook Live or Zalo chats. For success, marketers should localize content, go live, and engage with communities. Whether it’s contests, influencer collaborations, or viral challenges, authentic, social-first content wins in Vietnam.

With 86.7 million Internet users (73% of the population) and an average of 3 hours and 33 minutes spent daily on social media, the Philippines ranks among the most socially connected nations on the planet. A young, mobile-first population, with a deep love for pop culture, drives this hyper-engagement.

Facebook still tops the ranks with around 88 million users (many people maintain multiple accounts), and it’s the primary platform for news, entertainment, communication, and shopping. Facebook Groups are especially vibrant, ranging from local communities to fandoms. For brands, a strong, daily Facebook presence is essential.

YouTube is another powerhouse, especially for vlogs, music, and comedy – all in line with the country’s karaoke-loving, entertainment-centric culture. TikTok is surging, particularly among Filipino youth, thanks to its short-form, fun, and culturally resonant content. Filipino creators shine on the platform with dance trends and relatable skits.

Social commerce is massive. Live selling on Facebook is common, and influencer marketing (including micro- and nano-influencers) can move markets. Filipinos often trust and engage with influencers like friends. For best results, brands should be humorous, inclusive, and highly interactive. Witty comments, daily memes, and engaging replies go a long way.

Mobile-friendly content and responsive customer service via social media are crucial. In the Philippines, community management can make or break your brand, as one viral post can change everything.

Malaysia has around 29 million social media users (about 83% of the population), reflecting deep digital engagement across ethnic and language groups. The top platform by daily use is WhatsApp, with over 84% penetration – it’s the go-to for everything from family chats to small business transactions. WhatsApp Business is a must-have for customer service, inquiries, and updates.

Facebook remains the leading social feed platform, with around 20 million users (85% of internet users). Malaysians frequently engage with brand pages, join interest-based Facebook Groups, and participate in live selling. Meanwhile, YouTube reaches 93% of Malaysian internet users, popular for local comedy, reviews, and influencers. It's a prime video platform for brand visibility.

TikTok is the breakout star, with an estimated 19 million users (reaching over half of the population), rivaling Facebook’s reach. TikTok resonates with both rural and urban Malay-speaking youth, and influencer marketing is booming. Twitter and LinkedIn serve niche but influential audiences: Twitter for news and pop culture, especially in English-speaking circles; LinkedIn for a professional audience (over 7 million users), making it effective for B2B or premium services.

Language segmentation is key in Malaysia:

-Bahasa Malaysia dominates Facebook, TikTok, and YouTube

-English thrives on LinkedIn, Instagram, and Twitter

-Chinese/Tamil content lives in smaller but loyal circles on platforms like WeChat or Xiaohongshu

For brands, cultural localization is critical. Use the right language and tone for your target audience. Social commerce is widespread, and platforms like Instagram and Facebook are common selling grounds. Live product demos, influencer collabs, and engaging storytelling perform well. Malaysia’s diverse yet digitally unified landscape makes it an ideal test market in Southeast Asia, just be sure to speak the language, literally and culturally.

Indonesia has over 139 million social media users, roughly 50% of its population, and the number is still on the rise. Indonesians spend an average of 3 hours and 8 minutes daily on social media, using it to stay connected across the country’s 17,000+ islands. This heavy engagement reflects not only the country’s mobile-first habits but also its deep reliance on social platforms for news, entertainment, and communication.

Facebook has a massive user base in Indonesia (over 130 million). Many Indonesians who came online in the 2010s through affordable Android phones joined Facebook as their first online social experience. It accounts for over 90% of social media use in Indonesia, widely used for keeping up with friends and family, and also for local community groups. However, younger Indonesians are gravitating a bit more toward Instagram and TikTok for content. Instagram is very popular among urban youth and the emerging middle class as a place to showcase lifestyles.

Social commerce is huge in Indonesia. Many users buy and sell directly via Instagram, WhatsApp, or Facebook, often in informal, chat-based ways. Live streaming commerce is growing too, with sellers showcasing products in real time. Major e-commerce platforms like Tokopedia and Shopee integrate heavily with social ads and influencer marketing.

Indonesia is a mobile-first, video-obsessed market where community matters. Use Bahasa Indonesia, tap into local culture (especially during Ramadan), and team up with micro-influencers for real engagement. Keep content fun, visual, and lightweight, perfect for mobile and spotty connections. With only half the population online, the next wave of users is coming fast. To win them over, stay local, be inclusive, and make your content easy to enjoy anywhere, anytime.

Singapore has one of the world’s highest social media penetration rates, with 88.2% of its 5.85 million residents online. The average user spends just over 2 hours daily on social media and uses more than seven platforms monthly, making it a highly fragmented and fast-moving digital environment.

In terms of popularity, WhatsApp is the most used app in Singapore (about 80% usage), reflecting the emphasis on efficient communication in a fast-paced environment. TikTok is booming in watch time, with users spending an average of over 34 hours per month, and YouTube is used for both entertainment and learning, reflecting the country’s high education levels. LinkedIn also punches above its weight here, with a large professional class. Singapore has one of the highest per-capita LinkedIn usage rates (nearly 60% of adults on LinkedIn according to ad reach data).

Singaporeans are discerning, bilingual, and culturally diverse, so marketers must localize content, like using Singlish, referencing local events, or tailoring creatives for Chinese, Malay, and Indian audiences. Quality trumps quantity here: insightful, stylish, or useful content gets attention, while generic or hard-sell posts often flop.

On the advertising side, social media ad reach in Singapore is high, but growth is slower. Marketers often use Singapore as a testbed for sophisticated digital strategies (like experimenting with new ad formats on Instagram or trying LinkedIn video ads, etc).

Wondering how to market your company on social media in Asia? The key is knowing that what works in the US may fall flat here. Asia’s social media world is rich, fast-changing, and incredibly diverse. Success comes from localizing your strategy, understanding platform preferences, and respecting cultural habits. Here’s how to do it right:

Choose the right platforms for each market: Use WeChat Mini Programs and Douyin ads in China. Set up branded LINE accounts and Twitter ads in Japan. Run Instagram Story campaigns and WhatsApp broadcasts in Indonesia. Pick 2 to 3 top platforms per country to maximize your efforts.

Use first-party data to sharpen your targeting: Social media use is very high in places like Malaysia, Korea, and Singapore, but some groups, like older or rural users, are still catching up. As more people get online, many skip older platforms and go straight to apps like TikTok or WhatsApp. Watching these user trends and checking ad reach data, like how Facebook reaches over 100 percent of Filipinos aged 18 and up, helps you spend your budget where it works best.

Localize beyond translation: Partner with regional micro-influencers, celebrate local festivals in your posts, and design visuals using local aesthetics like anime in Japan or bold color culture in Thailand. You can also use local memes to engage the audience. Reply to comments in local languages and use culturally relevant hashtags to respect cultural nuances.

Asia’s social media landscape is massive and full of opportunity, but it’s also complex. Each country has its own favorite platforms, cultural habits, and ways users interact online. From TikTok rising fast in Vietnam to LINE dominating in Japan and Thailand, success here means going beyond global templates and truly understanding local behavior. Whether it’s livestream selling, meme marketing, or platform-specific strategies, data and cultural insight are key to making it work.

That’s where VGV Media Asia comes in. We specialize in turning this complexity into clarity, helping brands create tailored, high-impact campaigns across Asia. Our team combines creative digital marketing expertise with a deep understanding of regional trends and influencer marketing networks.

From strategy and influencer selection to content creation and campaign rollout, we handle everything under one roof. With our powerful Asian influencer database and focus on quality content, we help you spark real engagement and long-term brand growth.

Ready to break through the noise and grow your brand across Asia? Let VGV Media Asia lead the way. Get in touch now for a custom marketing consultation.